For businesses of all sizes, understanding their financial position is paramount to making informed decisions and achieving long-term success. A balance sheet is a vital financial statement that provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

Creating and analyzing blank balance sheet can be a complex task, but with the help of personal balance sheet template, you can streamline the process and gain valuable insights into your financial health. In this article, we will explore the benefits of using the template and how it can assist in performing detailed financial analysis.

Why is a Balance Sheet Essential?

Simplified Financial Reporting

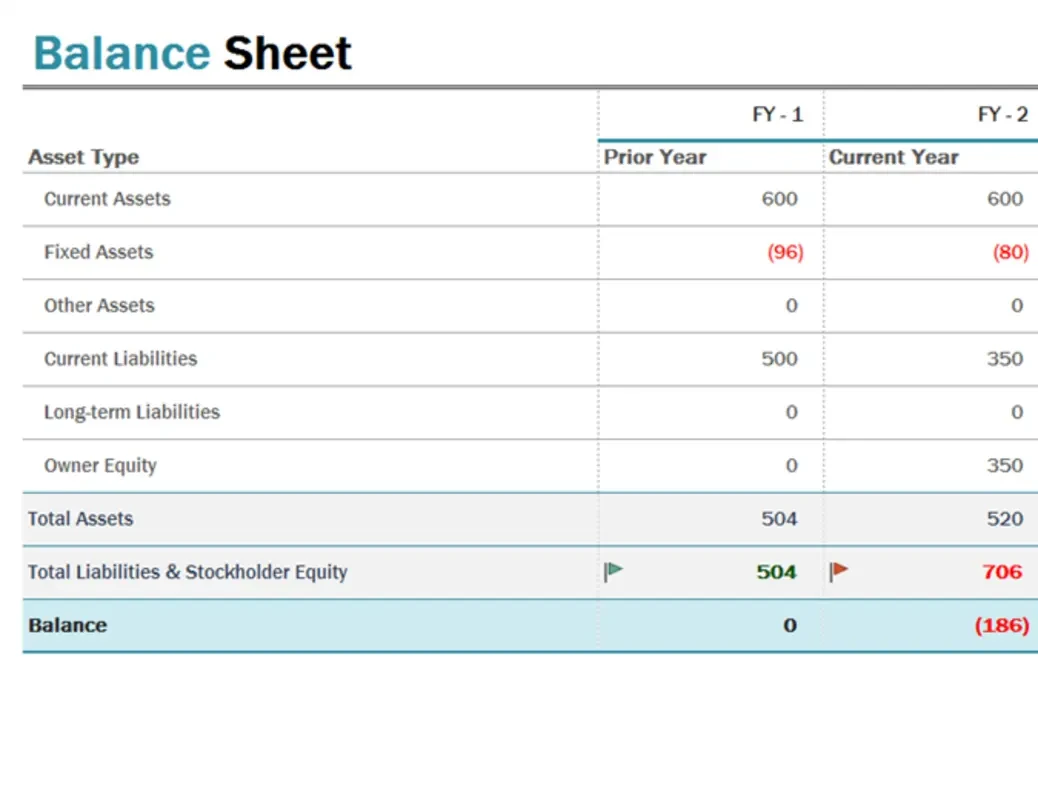

The template provides a structured format for organizing and presenting your financial information. With predefined categories and formulas, it simplifies the process of compiling and reporting your assets, liabilities, and equity. You can easily input your financial data and let the template automatically calculate totals, subtotals, and key ratios.

Efficient Analysis of Financial Health

Analyzing the balance sheet is crucial to understand a company’s financial health and evaluate its performance over time. An Excel template allows you to perform detailed analysis by using formulas and functions to calculate financial ratios, such as liquidity ratios (current ratio or quick ratio) or leverage ratios (debt-to-equity ratio or debt ratio). These ratios provide insights into liquidity, solvency, and overall financial stability.

Customization for Specific Business Needs

Excel templates are highly customizable, allowing you to tailor the sheet to your specific business requirements. You can modify the template by adding or removing rows, adjusting categories, or incorporating additional calculations. This flexibility enables you to create basic balance sheet template that accurately reflects your company’s unique financial structure.

Time and Effort Savings

Building the balance sheet from scratch can be time-consuming, particularly when dealing with complex financial data. By utilizing simple balance sheet format, you save significant time and effort. The template already includes formulas and calculations, eliminating the need to manually compute totals and subtotals. This time savings enables you to focus on analyzing the data and making informed financial decisions.

Clear Visualization of Financial Position

Excel provides powerful visualization tools that allow you to present your balance sheet data in a clear and visually appealing format. You can create charts and graphs to illustrate the composition of assets, liabilities, and equity. These visual representations provide a quick and comprehensive overview of your financial position, making it easier to identify trends and spot areas that require attention.

Improved Financial Planning and Decision Making

Personal balance sheet in Excel serves as a foundation for financial planning and strategic decision making. By regularly updating and analyzing small business balance sheet template, you gain insights into your company’s financial strengths and weaknesses. This information enables you to identify opportunities for growth, manage cash flow effectively, and make informed decisions to optimize your business operations.

Conclusion

Summing up, the template is a critical financial statement that provides valuable insights into a company’s financial health. By utilizing the template in Excel, you can streamline the process of creating and analyzing your financial position. With predefined categories, automatic calculations, and powerful analysis tools, the template empowers you to gain a comprehensive understanding of your company’s financial health, make informed decisions, and plan for future success. Embrace the efficiency and convenience of personal balance sheet template, and unlock the power of financial analysis for your business.