Planning for a mortgage can be a complex process, involving calculations, estimations, and considerations of various factors such as interest rates, loan terms, and down payments. To simplify this process and gain a clearer understanding of your mortgage payments, Mortgage Payment Calculator in Google Spreadsheet provides a powerful solution. This user-friendly tool allows you to calculate mortgage payments, estimate total interest paid. As well as explore different scenarios, empowering you to make informed financial decisions. In this article, we will explore the benefits of using Mortgage Payment Calculator how it can simplify your mortgage planning.

Quick and Accurate Mortgage Calculation

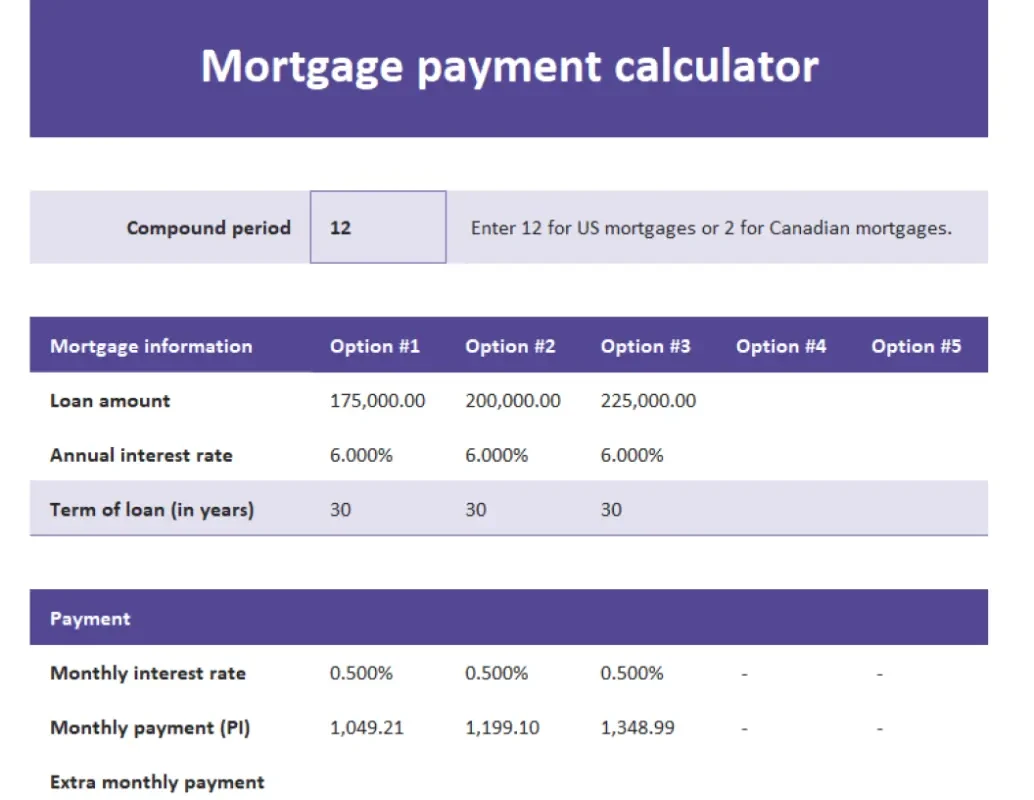

Mortgage Calculator in Google Spreadsheet offers a fast and accurate way to calculate mortgage payments. By inputting essential information such as loan amount, interest rate, loan term, and down payment. In addition the calculator instantly generates the monthly payment amount. This eliminates the need for manual calculations or relying on online calculators, giving you the freedom to explore different mortgage scenarios and assess their affordability.

Customization for Different Mortgage Types

Every mortgage is unique, and Mortgage Payment allows customization for different mortgage types. You can adjust variables such as interest rate, loan term, and down payment to explore various repayment options. This flexibility enables you to compare different mortgage scenarios and choose the most suitable one based on your financial situation and goals.

Estimate Total Interest Paid

Understanding the total interest paid over the life of a mortgage is essential for effective financial planning. With a Google Spreadsheet Mortgage Calculator, you can estimate the total interest paid by multiplying the monthly payment amount by the number of payments and subtracting the loan amount. This helps you evaluate the overall cost of the mortgage and make informed decisions about loan terms or refinancing options.

Scenario Planning and Comparison

Google Spreadsheet Mortgage Payment Calculator empowers you to conduct scenario planning and comparison. By adjusting variables such as loan amount, interest rate, loan term, or down payment, you can explore different mortgage scenarios and evaluate their impact on your budget. This allows you to make informed decisions based on your financial goals and select the mortgage option that best aligns with your needs.

Amortization Schedule Generation

An amortization schedule is a valuable tool that provides a detailed breakdown of each mortgage payment, including the principal and interest portions. With Google Spreadsheet Mortgage Payment Calculator, you can generate an amortization schedule. So that this illustrates the payment schedule and tracks the reduction of the mortgage balance over time. This allows you to visualize the progress of your mortgage and assess the impact of additional payments or changes in interest rates.

Enhanced Financial Decision-Making

Utilizing Payment Calculator enhances your financial decision-making capabilities. By having accurate and accessible mortgage calculations, you can evaluate mortgage affordability, assess the impact of different repayment options. In essence it’s make informed choices that align with your financial goals. This empowers you to take control of your finances and optimize your mortgage planning strategies.

Conclusion

Mortgage Calculator in Google Spreadsheet is a valuable tool that simplifies mortgage planning and empowers you to make informed financial decisions. By utilizing this user-friendly calculator, you can quickly calculate mortgage payments, estimate total interest paid, and explore different repayment scenarios. This enables you to plan your mortgage effectively, evaluate affordability, and choose the best mortgage option based on your financial situation. Simplify your mortgage planning process with Payment Calculator and gain control over your financial journey.