Managing loan repayments can be a complex task, especially when dealing with different interest rates, payment frequencies, and varying loan terms. To simplify the process and gain better visibility into your loan repayment journey, utilizing loan amortization schedule Excel template provides a valuable solution. This versatile tool allows you to create a comprehensive and customizable repayment schedule. As well as it’s helping you plan your payments, track progress, and make informed financial decisions. In this article, we will explore the benefits of using loan amortization schedule and how it can simplify your loan repayment process.

Clear Visualization of Loan Repayment

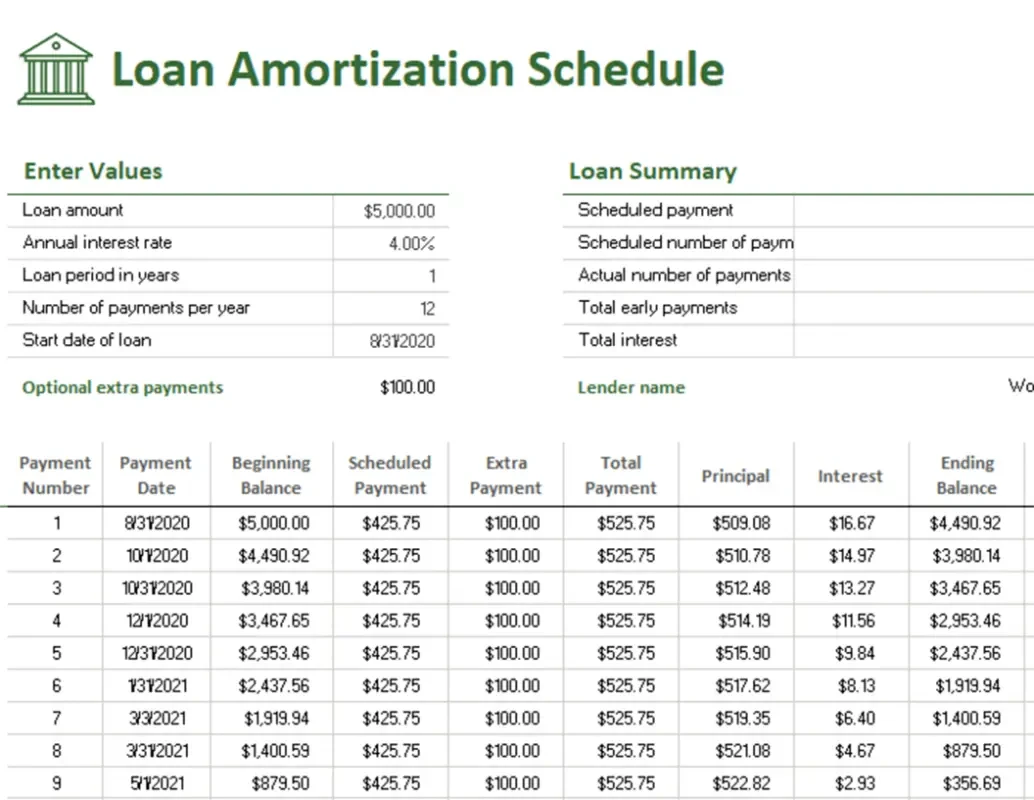

Loan amortization template provides a clear visual representation of your loan repayment plan. It breaks down your loan into individual payment periods, detailing the principal and interest components of each payment. By presenting the information in an organized and structured manner, the template allows you to understand how your payments contribute to reducing the loan balance over time.

Customizable for Various Loan Types

Every loan comes with its own terms, interest rates, and repayment options. A loan amortization schedule Excel template offers customization options to accommodate different loan types, including mortgages, personal loans, auto loans, or student loans. You can input specific details such as loan amount, interest rate, repayment term, and payment frequency to tailor the schedule to your loan’s characteristics.

Accurate Calculation of Interest and Principal

Calculating interest and principal portions of loan payments can be challenging, especially when dealing with amortizing loans. An Excel template automates the calculation process, ensuring accurate breakdowns of interest and principal amounts for each payment period. This helps you understand how much of each payment goes towards interest charges and how much is applied towards reducing the principal balance.

Forecasting Future Payments and Balances

With loan amortization schedule, you can project future payments and remaining balances based on your chosen repayment strategy. By adjusting payment amounts or adding extra payments, you can see how it impacts the loan term and the overall interest paid. This forecasting capability enables you to make informed decisions about accelerating payments, refinancing, or optimizing your repayment strategy.

Tracking and Analyzing Loan Progress

Loan amortization Excel template allows you to track and analyze the progress of your loan repayment. By comparing actual payments against the scheduled payments, you can assess whether you are on track and make adjustments if necessary. The template also provides insights into the total interest paid over the loan term. As a matter of fact, helping you evaluate the cost-effectiveness of the loan and consider potential refinancing options.

Financial Planning and Budgeting

Utilizing loan amortization schedule contributes to your overall financial planning and budgeting efforts. By having a clear understanding of your loan repayment schedule, you can better manage your cash flow, anticipate upcoming payments. As can be seen you can ensure you have sufficient funds allocated for loan obligations. This helps you maintain a realistic budget and make informed financial decisions based on your loan obligations.

Conclusion

In sum up, loan amortization template is a powerful tool that simplifies loan repayment planning and provides a clear overview of your loan obligations. By utilizing this customizable template, you can visualize your repayment journey, accurately calculate interest and principal amounts. In addition, you can forecast future payments, and track the progress of your loan. This valuable tool empowers you to make informed financial decisions, optimize your loan repayment strategy, and stay on top of your financial goals. Simplify your loan repayment process with loan amortization schedule Excel template and take control of your financial future.