Losing a loved one is a difficult and emotional experience, and dealing with the legalities that follow can be overwhelming. Probate, the legal process of distributing a deceased person’s assets, requires careful administration and documentation. One crucial aspect of this process is the inventory of the deceased’s assets, which plays a vital role in ensuring a fair and accurate distribution of their estate.

In this article, we will explore the significance of a probate inventory form and how it can streamline the probate process, providing ease and clarity during a challenging time.

Understanding the Probate Inventory Form

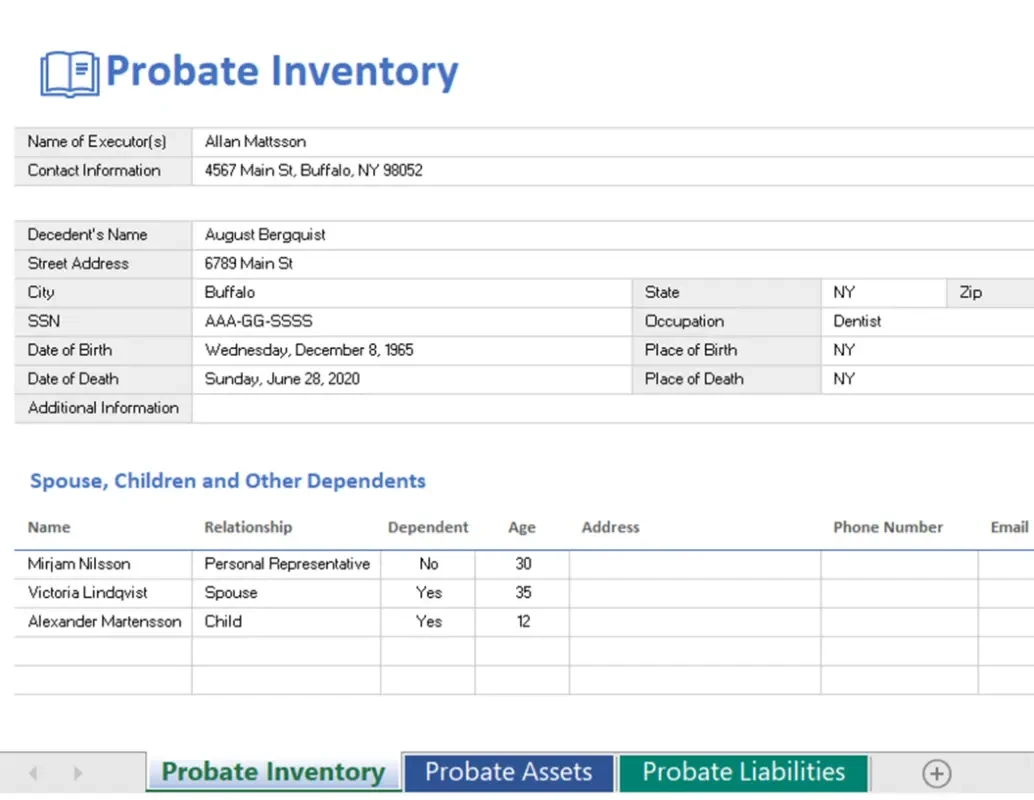

A probate inventory form is a comprehensive document that lists all the assets and liabilities of the deceased person’s estate. This includes real estate, bank accounts, investments, personal property, debts, and other valuable possessions. The purpose of this form is to create a detailed record that helps the executor or administrator of the estate manage and distribute assets appropriately.

Why is a Probate Inventory Form Essential?

- Organization and Efficiency: A probate inventory form brings order to the complexity of estate administration. By creating a systematic list of assets, it simplifies the process for the executor or administrator and helps avoid confusion or potential disputes among beneficiaries.

- Accurate Asset Valuation: The inventory form requires the executor to assign a value to each asset. This step ensures transparency and fairness during the distribution process. Accurately valuing assets is crucial for determining estate taxes and meeting legal obligations.

- Legal Compliance: Probate laws and regulations vary across jurisdictions, but many require the submission of an inventory form. Failing to provide an inventory can lead to legal complications and delays in the probate proceedings. By using the designated inventory form, executors can fulfill their legal obligations and avoid unnecessary hurdles.

- Identifying Unknown Assets and Liabilities: While some assets may be obvious, others may remain unknown to the executor or administrator. The inventory form prompts a thorough search for all assets, ensuring that nothing is overlooked. Additionally, it helps identify any outstanding debts or liabilities, allowing the estate to settle all obligations appropriately.

- Evidence of Due Diligence: By meticulously documenting the assets and liabilities, the inventory form acts as evidence of the executor’s diligence in fulfilling their duties. This can be particularly crucial in case of disputes among beneficiaries or challenges to the executor’s actions.

- Record for Future Reference: The inventory form serves as a valuable reference document for beneficiaries and the executor alike. It provides a snapshot of the estate at the time of the deceased’s passing and can be referred to during the estate settlement process or any future inquiries.

Conclusion

Navigating the probate process can be complex and emotionally challenging. However, by utilizing a probate inventory form, the executor or administrator can simplify the process, maintain accurate records, and ensure a fair distribution of assets. The form not only helps comply with legal requirements but also provides transparency, reduces disputes, and enhances efficiency.

During a difficult time, having a comprehensive inventory form can bring peace of mind to both the estate administrator and the beneficiaries. It streamlines the probate process and ensures that the deceased’s final wishes are carried out with precision and care.