Managing cash flow is crucial for the success and sustainability of any small business. Maintaining a healthy cash flow ensures that you have enough funds to cover expenses, meet financial obligations, and invest in growth opportunities. However, at the moment tracking and forecasting cash flow can be challenging without a proper system in place. That’s where a small business cash flow forecast Excel template becomes an invaluable tool. This versatile template provides a structured framework to track, analyze, and project your cash flow, empowering you to make informed financial decisions. In this article, we will explore the benefits of using the template and how it can optimize your cash flow management.

Comprehensive Cash Flow Tracking

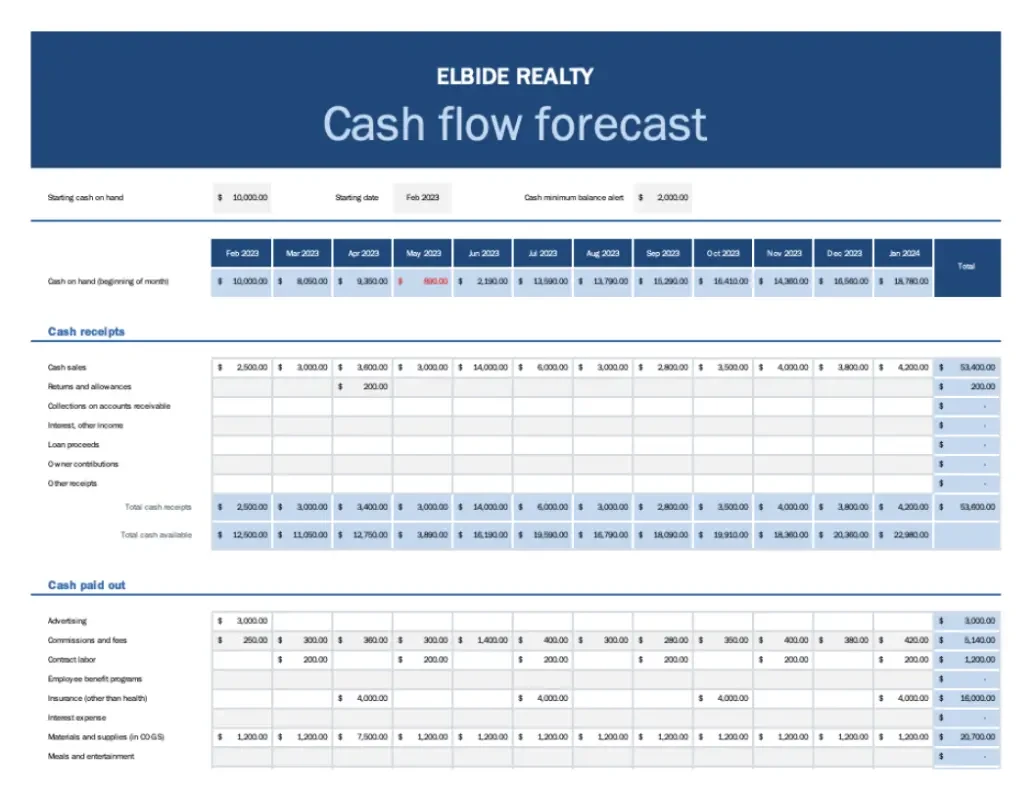

Cash flow forecast Excel template allows you to track and monitor your cash inflows and outflows in a comprehensive manner. The template typically includes sections to record revenue sources, such as sales or services, and various expense categories, such as rent, utilities, salaries, and inventory costs. By inputting these details, you can keep a close eye on your cash flow. Also you can identify potential bottlenecks or areas of improvement, and take proactive measures to optimize your financial position.

Accurate Cash Flow Projections

Forecasting cash flow is crucial for planning ahead and making informed financial decisions. The Excel template provides built-in formulas and functions that automate calculations and generate projections based on your historical data and assumptions. By analyzing past trends and considering future factors, such as seasonality or market changes, you can generate accurate cash flow projections for the coming weeks, months, or even years. This allows you to anticipate cash flow gaps, plan for necessary financing, and take proactive steps to ensure a stable financial position.

Cash Flow Analysis and Insights

An Excel template for small business cash flow forecasting provides valuable insights into your financial performance. By summarizing your cash flow data, the template allows you to analyze trends, identify patterns, and assess the impact of various factors on your cash flow. This analysis helps you understand the drivers of your cash flow, evaluate the effectiveness of your revenue and expense management strategies, as well as make informed decisions to optimize your financial position.

Scenario Planning and Sensitivity Analysis

The flexibility of an Excel template allows you to conduct scenario planning and sensitivity analysis to assess the potential impact of different variables on your cash flow. You can create multiple scenarios, such as best-case, worst-case, or moderate-case, and evaluate their effects on your cash flow projections. As can be seen this helps you develop contingency plans, assess risks, and make strategic decisions to mitigate potential cash flow challenges.

Customization and Scalability

Excel templates for small business cash flow forecasting are highly customizable to fit your specific needs. You can add or remove rows or columns, modify formulas, or incorporate additional tabs to track different aspects of your cash flow. Furthermore, as your business grows, the template can be easily scaled up to accommodate a larger volume of transactions and data without requiring significant adjustments.

Conclusion

In conclusion, optimizing cash flow is crucial for the success and growth of a small business. As shown above small business cash flow forecast template in Excel provides a structured and efficient approach to track, analyze, and project your cash flow. In other words this powerful tool, you can gain better visibility into your financial position, make informed decisions, and take proactive measures to optimize your cash flow. Embrace the power of a small business cash flow forecast Excel template and unlock the potential for improved financial management and long-term business success.